“The more sand has escaped from the hourglass of our life, the clearer we should see through it.” — Niccolo Machiavelli

On March 21 I posted a blog stating that President Obama wanted us to pay $5.00 per gallon of gasoline and more. Since hat posting the price for a gallon of regular (87 octane) gasoline has climbed to $4.25 per gallon in my neck of the woods and in some regions it is quickly approaching the $5.00 mark.

In my blog post I cited the example of how the commodities market works and investors (some call them speculators) buy and sell commodities using something called futures. A futures is what you think a commodity like orange juice, hog bellies, corn, wheat or oil will sell for 30, 60 or 90 days down the road. In essence it’s a bet.

Say you are studding the market for corn. You see that the government is pushing ethanol as a fuel additive and corn is selling for $10.00 per bushel. After your research you bet, that due to the government intervention in the corn market, you think corn will sell for $11.00 per bushel in 90 days. You figure farmers will grow more field corn to sell to for the production of ethanol and less corn for the production of corn syrup and human consumption. This will bring up the demand for corn and thusly the market price.

90 days after you buy you futures at $10.00 per bushel the market price for corn rises to $11.00 so you sell the bushels of corn you purchased for $10.00 and make a 10% profit on your investment in corn futures. To do this you never actually process bushels of corn and store them in your garage of shed, you merely own a piece of paper stating that you control so many bushels of corn. When you sell your corn futures you will be taxed on the 10% profit in the form of a capital gain tax.

On the other hand if there is an abundance of corn and in 90 days the price drops to $8.00 per bushel you will be left holding the bag for a 20% loss — something you don’t want to happen. This is what commodities traders spend a great deal of time studying a particular market. In he instance of corn they would be looking at the fuel additive market, driving patterns, weather, and other demands and influences on the supply and demand for corn. Most of this trading is done at the Chicago Commodities Exchange.

Oil works the same way, except the normal future period is 30 days. Oil companies don’t but oil futures, they buy real barrels of oil on the Spot Market at something called the Spot Price. However, the price for oil on the spot market is set by the supply and demand, not the futures market. The futures market is just a place where you bet on the price, but it does influence the selling price of crude oil.

The quickest way to reduce the price of crude oil is to increase the supply. I don’t think it takes a rocket scientist to understand this fact. This is the way the Organization of the Petroleum Exporting Countries (OPEC) controls the price of oil. Headquartered in Vienna, one of OPEC’s principal goals is “the determination of the best means for safeguarding the organization's interests, individually and collectively. It also pursues ways and means of ensuring the stabilization of prices in international oil markets with a view to eliminating harmful and unnecessary fluctuations; giving due regard at all times to the interests of the producing nations and to the necessity of securing a steady income to the producing countries; an efficient and regular supply of petroleum to consuming nations, and a fair return on their capital to those investing in the petroleum industry.”

When one nation, say Libya, reduces its oil production the other states are supposed to increase theirs in order to spike production and keep world-wide oil prices stable. Also, no state will over produce causing a drop in prices for the other states; in essence it’s the largest cartel in the world.

OPEC's ability to control the price of oil has diminished somewhat since then, due to the subsequent discovery and development of large oil reserves in Alaska, the North Sea, Canada, the Gulf of Mexico, the opening up of Russia, and market modernization. As of November 2010, OPEC members collectively hold 79% of world crude oil reserves and 44% of the world’s crude oil production, affording them considerable control over the global market. The next largest group of producers, members of the OECD and the Post-Soviet states produced only 23.8% and 14.8%, respectively, of the world's total oil production. As early as 2003, concerns that OPEC members had little excess pumping capacity sparked speculation that their influence on crude oil prices would begin to slip.

There are several factors that influence the price of a gallon of gasoline. There are items such as refinery capacity, demand, cost of transportation, environmental regulations and of course the largest — the price of a barrel of crude. The quickest way to reduce the price of a gallon of gasoline is to reduce the price of a barrel of crude and that is done by increasing the supply and this is done by increasing production.

Right now Canada provides the United States with approximately 22% of our crude oil. Also, Canada and the United States have more oil reserves than all of the OPEC nations. The problem is that our government and environmental special interest groups are prohibiting us from extracting this oil for various reasons. President Obama has declared that he wants the price of gasoline to rise to $10.00 per gallon so he and his environmental and left-wing supporters can wean us off the internal combustion engine and get Americans into public transit and alternative energy sources. This is way he supports Cap and Trade.

This is a bone-headed policy and why Obama will not tell the world of oil investors that we are opening all of our oil reserves for extraction. This one statement would be like an atomic bomb to the oil futures market and the price of oil would begin to plummet. This is not Obama’s game plan. If we opened the Gulf of Mexico to drilling, as the Brazilians and Chinese are doing, released the oil leases of the coast of California, opened Anwar in Alaska and got out of the way of the extraction of the Bakken shale oil formations in North Dakota and Montana we would be oil independent of OPEC.

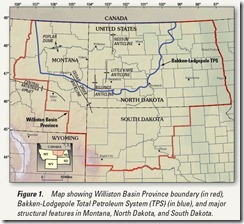

One of the least reported on oil reserve is the Williston Basin in North

“Recoverable shale oil with current technology is apparently 20% although two companies drilled two laterals in the same section in Mountrail County last summer. Up until those, the procedure was to go down vertically in one corner of a section (square mile) and drill horizontally (the lateral) at a diagonal across the section. (The closing scenes in the video are not Bakken wells — the wells are too close together.) One lateral in each section taps into a very small amount of the shale formation. Multiple laterals in one section may substantially increase the recoverable amounts. I've seen the Bakken crude and seen chemical analyses of it — it is very close to kerosene or diesel fuel - some of the sweetest crude in the world. Initial production from the Bakken wells ranges from 300 to 2400 barrels per day depending on location since the shale seems to be different in different areas.”

I have not verified this report and it seems to contradict the estimates of other sources, including the U.S. Geological Survey. However, I received this information from a reliable source and the reporter seems to know what he or she is talking about. I find the 500 billion barrels number to be off the chart. As stated above the highest number I have seen is 18-24 billion. Even so, it’s a considerable amount of oil within our national boundary, and I am sure, as with all past oil estimates this number will increase with further exploration and advancements in drilling technology. Since the discovery of oil in near Titusville, Pennsylvania in 1859 by Edwin Drake there have been numerous claims of the world running out of it as illustrated by the remark "We're running out of oil!" — Harold Ickes, U.S. Secretary of the Interior, 1943.

This is one of the reasons North Dakota is one of the few states running a budget surplus and an unemployment rate of 3.8%. “Unemployment is 3.8%, and according to a Gallup survey last month, North Dakota has the best job market in the country. Its economy "sticks out like a diamond in a bowl of cherry pits," says Ron Wirtz, editor of the Minneapolis Fed's newspaper, fedgazette. The state's population, slightly more than 672,000, is up nearly 5% since 2000.

When you begin adding up all of our oil reserves the number surpasses that of OPEC and it’s easy to see that by some simple actions by our federal government gasoline prices could plummet to below $2.00 per gallon within a year as it was a few years ago. Of course states like California would lose billions in tax from a lower price per gallon as California imposes a 8% sales tax on a the price of gasoline — including the state and federal gasoline tax of $0.36 per gallon. This would be quite a blow for Jerry Brown and his big spenders.

So, don’t blame the oil companies or commodities investors for the high price of gasoline as Bill O’Reilly does, instead focus your ire where it belongs — at the feet of the environmental lobby, Congress and Barack Obama.

To view an animated video of how Bakken shale oil is extracted click here. The technology involves will fascinate you.

No comments:

Post a Comment